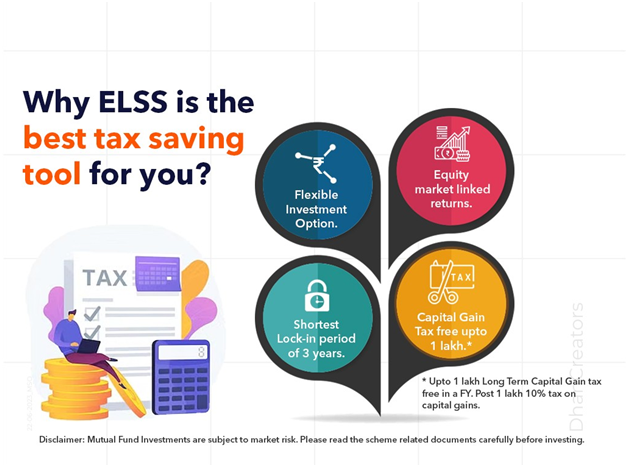

ELSS FUNDS

ELSS stands for Equity-Linked Saving Scheme. It is a type of mutual fund that provides tax benefits under Section 80C of the Income Tax Act. ELSS funds invest primarily in equity and equity-related instruments, which have the potential to generate higher returns than other tax-saving instruments such as fixed deposits and Public Provident Fund (PPF). ELSS funds have a lock-in period of three years, which means that you cannot withdraw your investment before three years. ELSS funds are suitable for investors who have a high-risk appetite and are looking for long-term wealth creation while also saving on taxes.