![]()

Equity Funds

These funds primarily invest in equities or equity-related instruments. They carry higher market risk compared to debt funds but also provide potential for long-term capital appreciation.

Mutual Funds are investment vehicles that pool money from multiple investors and invest in a diversified portfolio of securities such as equities, debt instruments, and other assets. They provide investors with the benefit of diversification, professional management, and liquidity.

Investors can choose from different categories of mutual funds depending on their risk profile, investment horizon, and financial objectives. Below are some broad types of mutual fund schemes:

![]()

These funds primarily invest in equities or equity-related instruments. They carry higher market risk compared to debt funds but also provide potential for long-term capital appreciation.

![]()

Debt funds invest in fixed-income instruments such as bonds, debentures, and money market securities. They are generally considered lower risk than equity funds, though returns are not guaranteed.

![]()

Hybrid funds allocate investments across both equity and debt instruments, offering a balance between growth and stability. The risk level varies depending on the allocation mix.

![]()

Index funds track a specific market index such as the Nifty 50 or Sensex. Their performance mirrors the underlying index and they typically have a lower expense ratio.

![]()

These funds focus on a particular sector such as IT, pharma, or banking. They carry concentrated risk as their performance depends on the chosen sector.

![]()

ELSS are equity mutual funds that qualify for tax deductions under Section 80C of the Income Tax Act. They come with a 3-year lock-in period. Returns are market-linked and not assured.

![]()

These funds invest in companies or securities outside India, offering geographical diversification. They are subject to global market risks and currency fluctuations.

![]()

ETFs are similar to index funds but are traded on stock exchanges like individual stocks. They combine the features of mutual funds and equities and typically have lower costs.

![]()

SIP allows investors to invest a fixed amount in mutual funds at regular intervals. It helps inculcate discipline, offers the benefit of rupee cost averaging, and reduces the impact of market volatility over time.

![]()

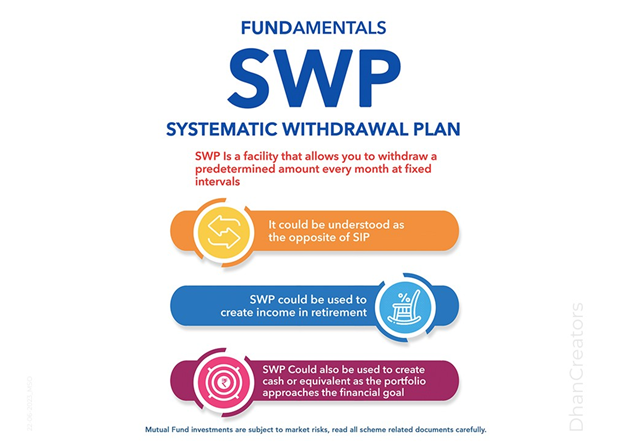

SWP enables investors to withdraw a fixed amount at regular intervals from their mutual fund investments, providing a potential income stream. Withdrawals are subject to market performance and tax implications.

These are some of the commonly available categories of mutual fund schemes. Investors should evaluate their risk profile, investment horizon, and financial goals before making any investment decision. Past performance is not indicative of future results. Mutual fund investments are subject to market risks — please read all scheme-related documents carefully.